More From News

UIII Builds a Bridge to Costa Rica

February 26, 2026

UIII Strengthens Its Academic Resources with Read Japan Project

February 25, 2026

September 8, 2025

By Teguh Yudo Wicaksono

VLADIVOSTOK, RUSSIA – In an era of escalating geopolitical tensions, where sanctions, tariffs, and control over critical financial networks are increasingly wielded as instruments of state power, a compelling new model for economic self-determination is taking shape in Southeast Asia. This was the central message delivered by Teguh Yudo Wicaksono, a fellow at Indonesian Institute for Foreign Affairs and also an Assistant Professor of Economics at Universitas Islam Internasional Indonesia, who presented a powerful case for a new form of financial sovereignty during an expert session at ‘The Future of the World’ Open Dialogue held here on Friday.

Opening the discussion, Maksim Oreshkin, Deputy Head of the President of the Russian Federation, stressed that new global trade solutions are now being driven by BRICS and the Global South, setting a powerful theme for the day’s conversation.

Speaking on “Investments in Connectivity,” Wicaksono argued that the “post-war consensus on globalization is over,” replaced by a harsh reality of geoeconomics. For nations in the Global South, this presents a critical challenge but also a “generational opportunity” to balance global integration with national sovereignty.

Speaking on “Investments in Connectivity,” Wicaksono argued that the “post-war consensus on globalization is over,” replaced by a harsh reality of geoeconomics. For nations in the Global South, this presents a critical challenge but also a “generational opportunity” to balance global integration with national sovereignty.

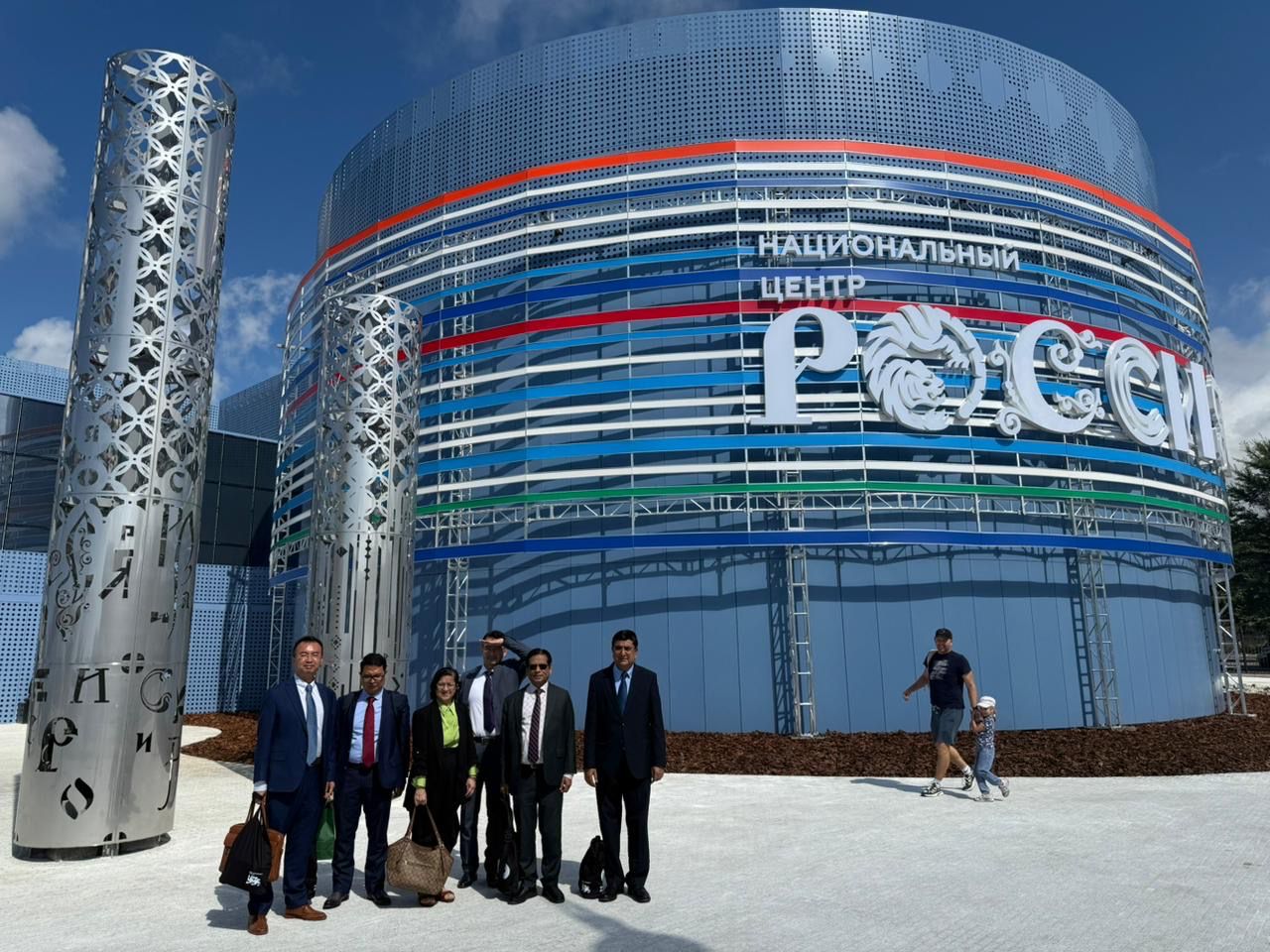

Hosted by the National Centre Russia at its Primorye branch, the session heard how Indonesia and its ASEAN partners are actively de-risking their economies from a structural dependency on the U.S. dollar—a vulnerability that left deep scars during the Asian Financial Crisis of 1997-98 and the 2007-09 global downturn.

“For us, global volatilities have real impact and affect real people,” Wicaksono stated, outlining a pragmatic two-pronged strategy Indonesia has deployed to build resilience.

“For us, global volatilities have real impact and affect real people,” Wicaksono stated, outlining a pragmatic two-pronged strategy Indonesia has deployed to build resilience.

The first prong involves forging bilateral Local Currency Settlement (LCS) agreements with key trading partners, including China, Japan, Malaysia, and Thailand. These meticulously negotiated frameworks allow importers and exporters to transact directly in their own currencies, bypassing the need for costly conversions through a dominant third currency. This approach not only reduces transaction costs for businesses but, more importantly, insulates regional trade from exchange rate volatility tied to geopolitical and monetary shocks occurring far beyond their borders.

The second, and perhaps more transformative, prong is a drive for domestic digital innovation. Wicaksono highlighted the success of the Quick Response Code Indonesian Standard (QRIS), a single, interoperable national standard for digital payments. The initiative has successfully brought over 38 million merchants—the vast majority being micro, small, and medium-sized enterprises (MSMEs)—into the formal digital economy, creating a powerful foundation of domestic financial strength.

This national success is now being scaled into a broader regional vision. “In a fragmenting world, the regional cooperation like ASEAN becomes more important,” Wicaksono explained.

This national success is now being scaled into a broader regional vision. “In a fragmenting world, the regional cooperation like ASEAN becomes more important,” Wicaksono explained.

Through the ASEAN Regional Payment Connectivity initiative, the goal is to create an integrated payment system across nine countries. With the regional digital payment market projected to exceed $1.2 trillion by 2025 and intra-ASEAN trade settled in local currencies already surpassing 25%, this vision is rapidly materializing.

Wicaksono concluded that financial connectivity and economic sovereignty are not opposing forces but complementary pillars. By championing open standards and robust supervision, ASEAN is not just building a more efficient payment network. It is, he argued, “offering a blueprint for how emerging economies can navigate the turbulent era of geoeconomics—not as passive recipients of a system designed by others, but as the architects of their own resilient future.”

Universitas Islam Internasional Indonesia